Judge blocks California law aimed at President Trump’s tax returns

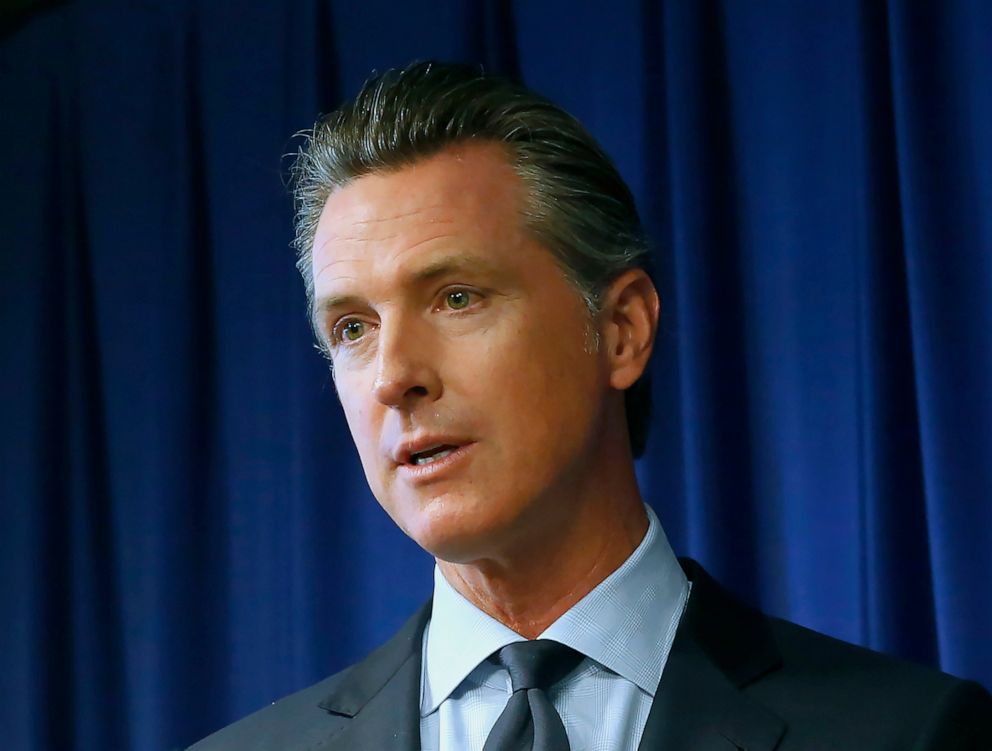

A federal judge has blocked a California law signed by Gov. Gavin Newsom requiring all presidential candidates, including President Donald Trump, to fork over their tax returns if they wish to appear on the state’s primary election ballot in 2020.

Interested in Donald Trump?

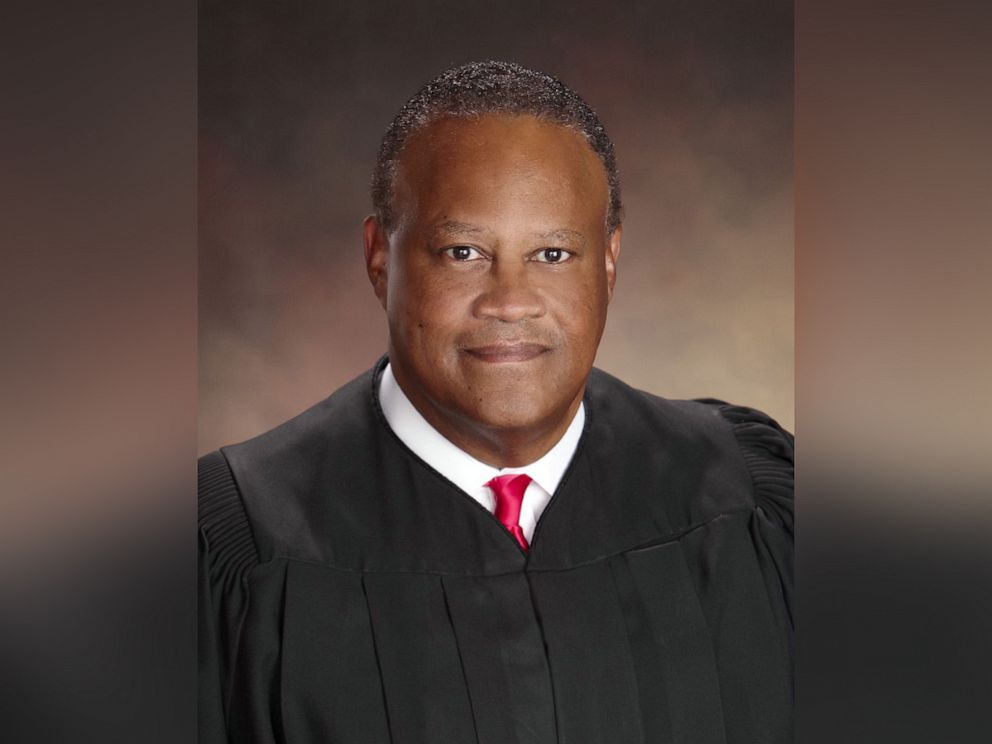

U.S. District Court Judge Morrison C. England Jr. of the Eastern District of California issued a 24-page ruling on Tuesday granting a request from the plaintiffs — including Trump, his reelection campaign and the Republican National Committee — for a preliminary injunction against the state’s Presidential Tax Transparency & Accountability Act.

England ruled that the law likely violates several articles of the U.S. Constitution, including First Amendment rights by depriving candidates access to the ballot and the 14th Amendment’s equal protection clause.

The judge wrote in his ruling that the plaintiffs “demonstrated irreparable harm” and have “shown that the balance of equity weighs in their favor.”

Newsom signed the bill into law in July after it was overwhelmingly passed by the state Legislature. The law requires both presidential and gubernatorial candidates to submit five years of personal tax returns before they can appear on the primary ballot.

The law does not apply to general elections.

“These are extraordinary times and states have a legal and moral duty to do everything in their power to ensure leaders seeking the highest offices meet minimal standards, and to restore public confidence. The disclosure required by this bill will shed light on conflicts of interest, self-dealing, or influence from domestic and foreign business interest,” Newsom said in a statement at the time.

Trump’s team immediately challenged the law in federal court. In a statement, the president’s personal attorney, Jay Sekulow, accused Newsom, a Democrat, and California’s Democratic-controlled Legislature of attempting to “circumvent the Constitution.”

In his ruling, Judge Morrison, who was nominated to the U.S. District Court in 2002 by former President George W. Bush, wrote that the state’s “concerns are both legitimate and understandable” and “are undermined when candidates offer unnecessary and irrelevant excuses for shielding the public from such information.”

“It is not the job of the courts, however, to decide whether a tax return disclosure requirement is good policy or makes political sense,” Morrison wrote. “Those are questions delegated to the political branches of the federal government, that is Congress and the President, under Articles I and II of the United States Constitution. Those are the branches that make the law.”

California Secretary of State Alex Padilla said he will appeal Morrison’s ruling, saying in a statement, “This law is fundamental to preserving and protecting American democracy.”

But Jessica Millan Patterson, chairwoman of the California Republican Party, hailed Morrison’s ruling as a victory against the “Democrats’ petty politics and their efforts to disenfranchise millions of California voters and suppress Republican voter turnout.”

Trump broke with modern precedent as a White House candidate in 2016 when he refused to release his personal tax returns and has continued to do so while in office. Most presidents since Richard Nixon have voluntarily released their tax returns over the past 40 years, which is not required by law.

The president has said he continues to be under audit from the Internal Revenue Service, which the agency will not confirm nor deny.

In May, House Democrats on the Ways and Means Committee subpoenaed the Internal Revenue Service commissioner and the Treasury secretary for six years of Trump’s tax returns. The request was rejected.

In a letter to the Democratic chairman of the House Ways and Means Committee, Treasury Secretary Steve Mnuchin repeated the argument that the Justice Department had advised him that Democrats’ demand had no “legitimate legislative purpose.”

Mnuchin accused House Democrats of “weaponizing the IRS” by trying to obtain Trump’s tax returns and suggested the battle may ultimately have to be decided by the courts.

Source: Read Full Article