Spotify CEO admits he got 'carried away' investing, will rein in spending this year

Spotify (SPOT) CEO Daniel Ek told investors on Tuesday he overspent in 2022.

Speaking on the company's fourth quarter earnings call, Ek said certain mistakes were made after the company heavily invested in high-growth areas like podcasts, telling investors: "I probably got a little carried away and over-invested."

Ek, who called out a shaky macroeconomic environment, emphasized the company will be tightening investments in 2023 across the board as the music streaming giant doubles down on streamlining efficiencies "with greater intensity."

"Some investors don't believe we're serious about that but we're really focused on driving efficiency moving forward," Ek reiterated, noting recent layoffs and company restructuring plans were done in an effort to couple speed with efficiency.

Spotify stock, which lost more than two-thirds of its value in 2022, gained as much as 9% in early trade following these results.

"The next era of Spotify is one where we're adding speed plus efficiency — not just growth at all costs — that's a big shift…but now we're going to have to live up to that," Ek said.

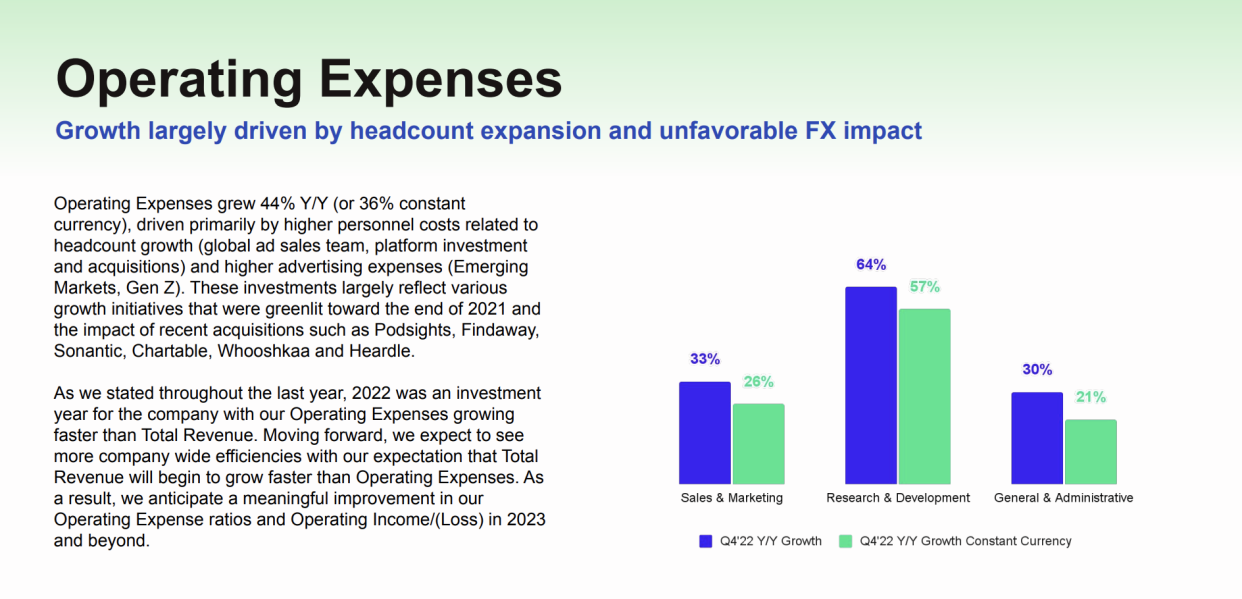

Spotify reported a wider-than-expected loss in the fourth quarter amid higher personnel costs primarily due to headcount growth, higher advertising costs, and currency movements.

Operating expenses grew 44% year-over-year as a result, although the company continued to categorize 2022 as a peak investment year with significant improvements expected in 2023.

Investors have remained hyper-focused on Spotify's declining gross margins, which hit 25.3% in the fourth quarter, beating expectations for 24.5%. The company said this margin improvement was "due primarily to lower investment spending and broad-based music favorability." Spotify guided a Q1 dip in gross margins to 24.9% amid "severance-related charges" after the company laid off 6% of its workforce last week.

Spotify said it still expects gross margins to come in between 30% to 35% over the long term amid plans to further scale its podcasting and ad business. However, execution remains murky amid macroeconomic challenges.

"Some of the investments we made in the back half of year [are] slightly impacting Q1 and will moderate throughout the year," Spotify CFO Paul Vogel said on the call when asked about gross margin impact.

Vogel said the first quarter will be the low point for gross margins, adding the metric should "improve throughout the year with nice trajectory heading out of 2023."

Vogel said investors should also see meaningful improvements in operating losses in 2023 relative to 2022. No timeline was offered on a break-even point, but the executive stressed the company is "on a good path and in a good position to have that speed and efficiency we want to have in 2023."

In a modest surprise, the company did not raise prices on its U.S.-based premium subscription plan, despite recent hikes at Apple Music (AAPL) and YouTube Premium (GOOGL).

"Nothing specific to announce at this point," Ek said on the call, noting the company increased price points in 40 markets around the world in 2022 but has taken "a balanced portfolio approach" when it comes to its pricing strategy.

Spotify's total monthly active users topped expectations in the fourth quarter, coming in at 489 million against forecasts for 478 million with both premium and ad-supported subscribers surging past estimates.

Premium subscribers grew 10 million in the quarter to reach 205 million; ad-supported users jumped by 22 million to total 295 million. Spotify said it expects first quarter subscribers to come in at 500 million, beating estimates of 492.2 million.

Alexandra is a Senior Entertainment and Media Reporter at Yahoo Finance. Follow her on Twitter @alliecanal8193 and email her at [email protected]

Click here for the latest trending stock tickers of the Yahoo Finance platform

Click here for the latest stock market news and in-depth analysis, including events that move stocks

Read the latest financial and business news from Yahoo Finance

Download the Yahoo Finance app for Apple or Android

Follow Yahoo Finance on Twitter, Facebook, Instagram, Flipboard, LinkedIn, and YouTube

Source: Read Full Article